Impressive Tips About How To Write A Accounting Report

1 choose a topic based on the assignment.

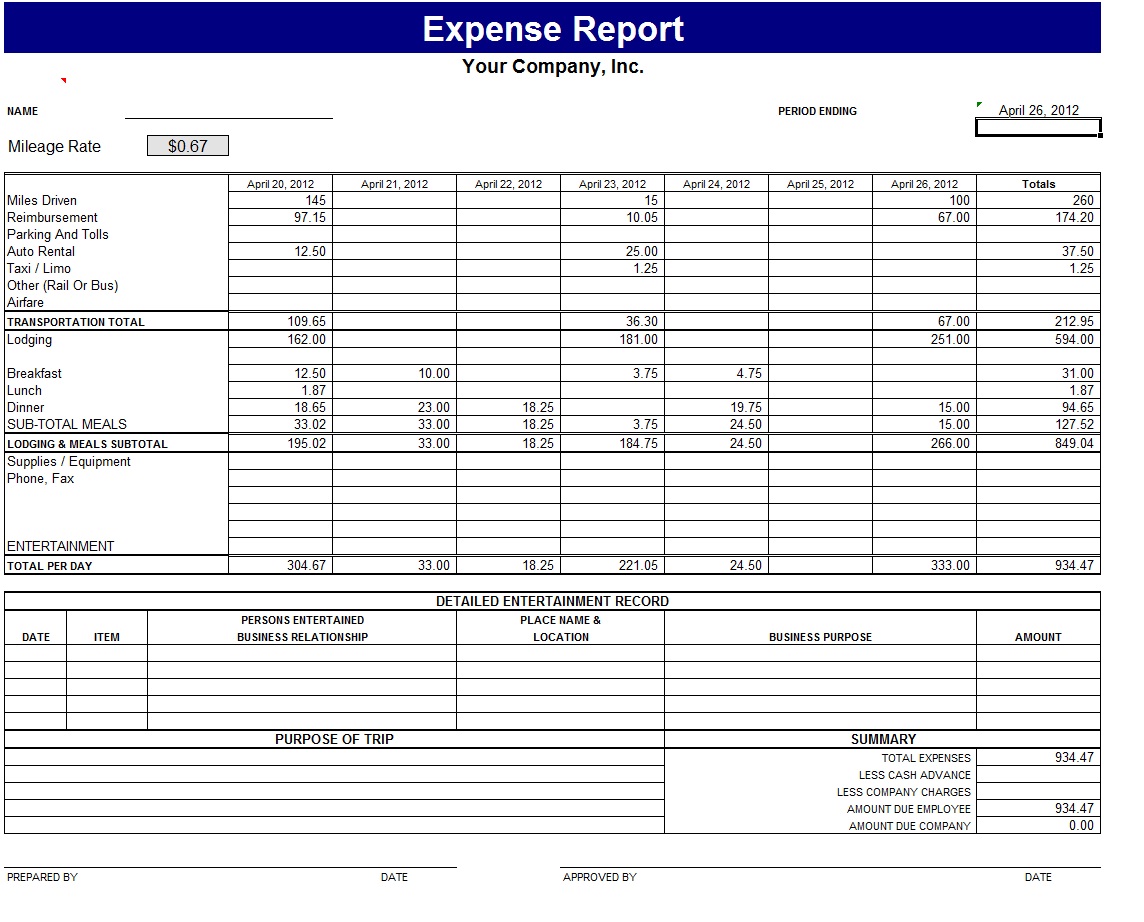

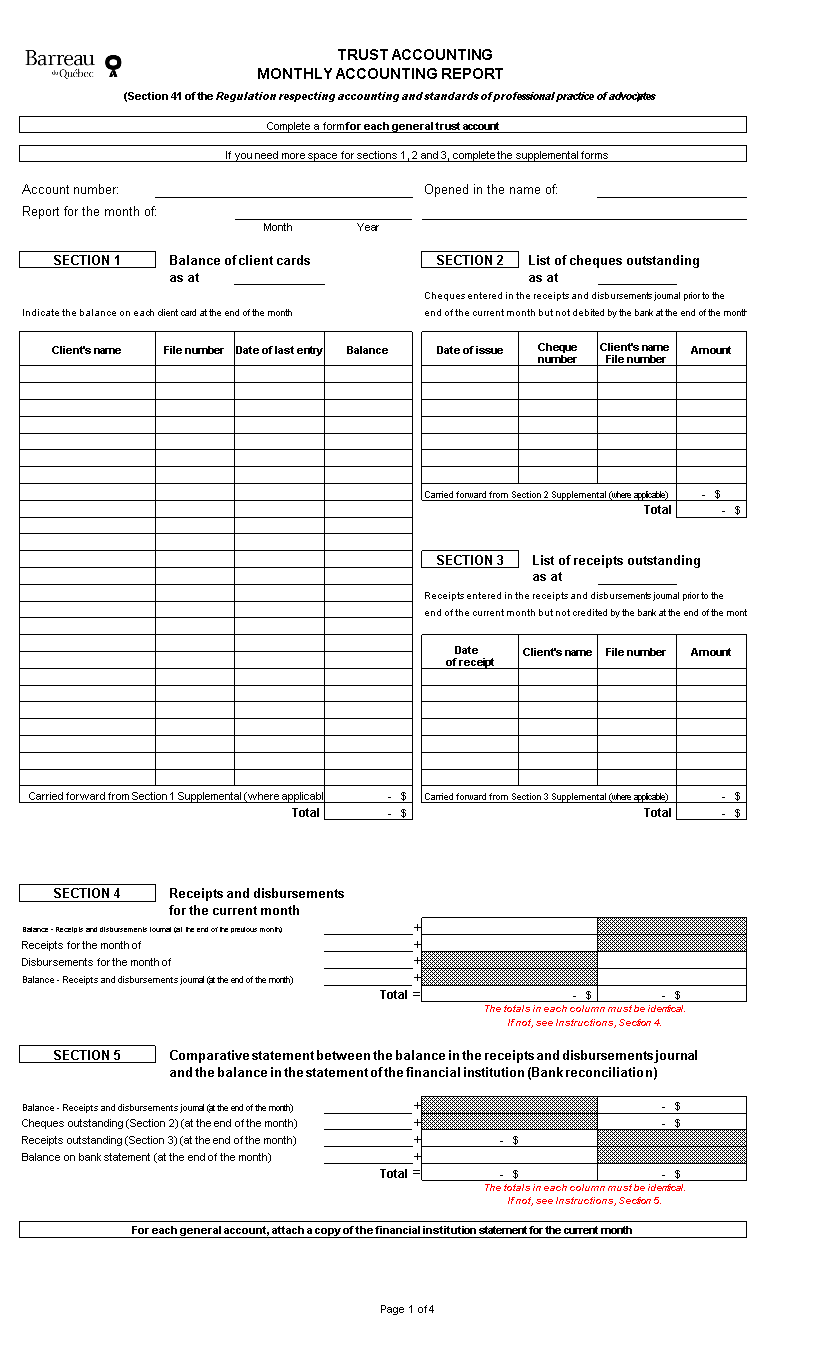

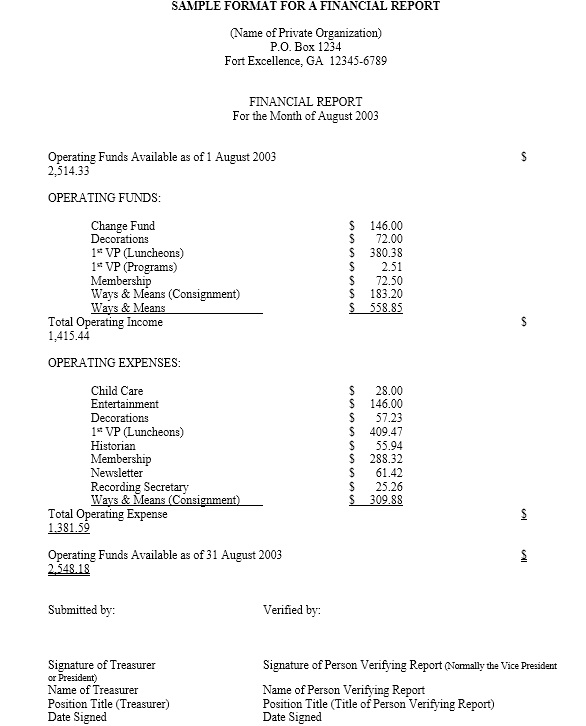

How to write a accounting report. But many have only indecipherable numbers and statistics of doubtful use. Accounting reports also include financial statements such as cash flow statements, profit and loss statements, and. Learning more about accounting reports and how they are compiled may help you succeed in an accounting, business or financial role.

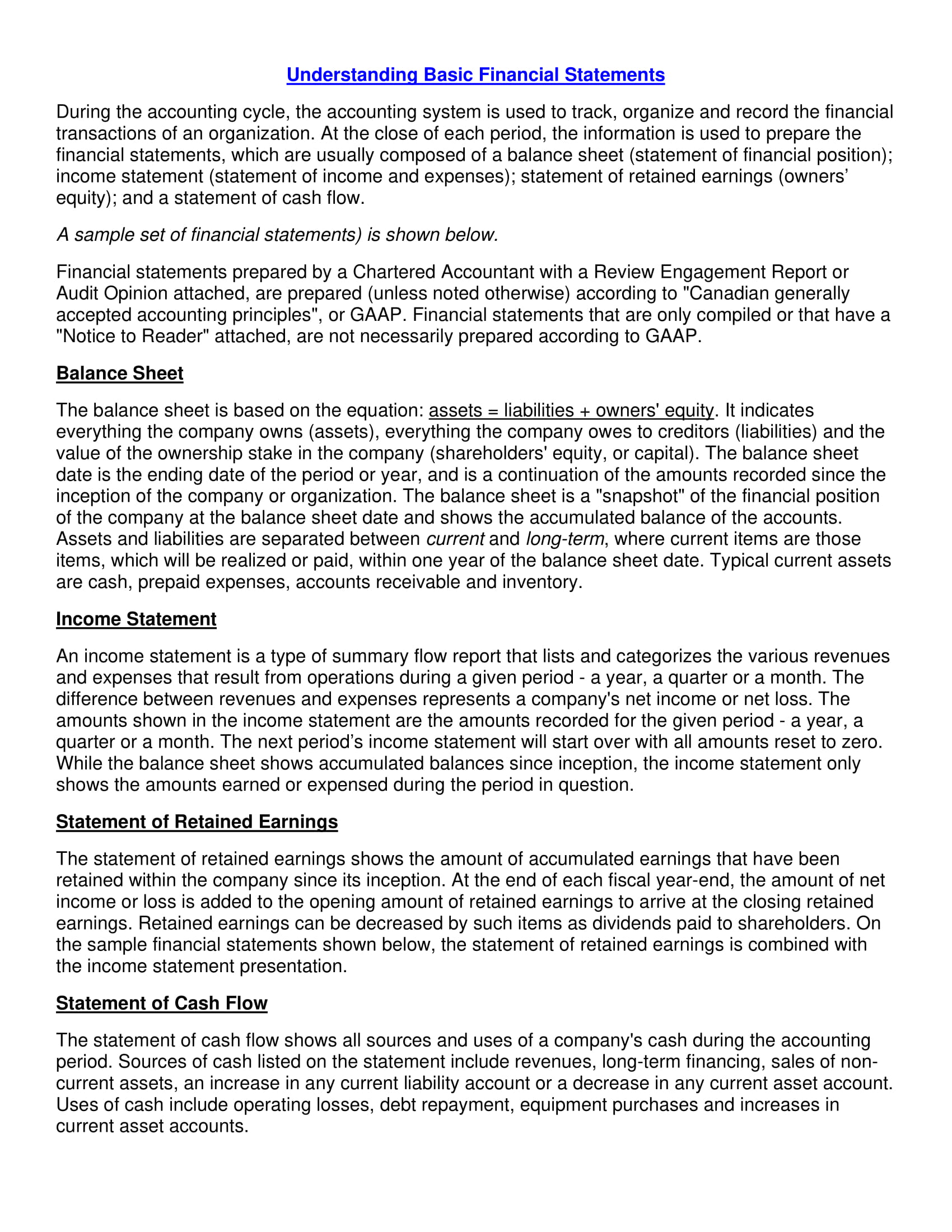

This shows the value of the shareholders’ portion of a company. Cash flow data asset and liability evaluation fellow equity research profitability bemessungen related: Do your financial reports really make a difference in managing the business?

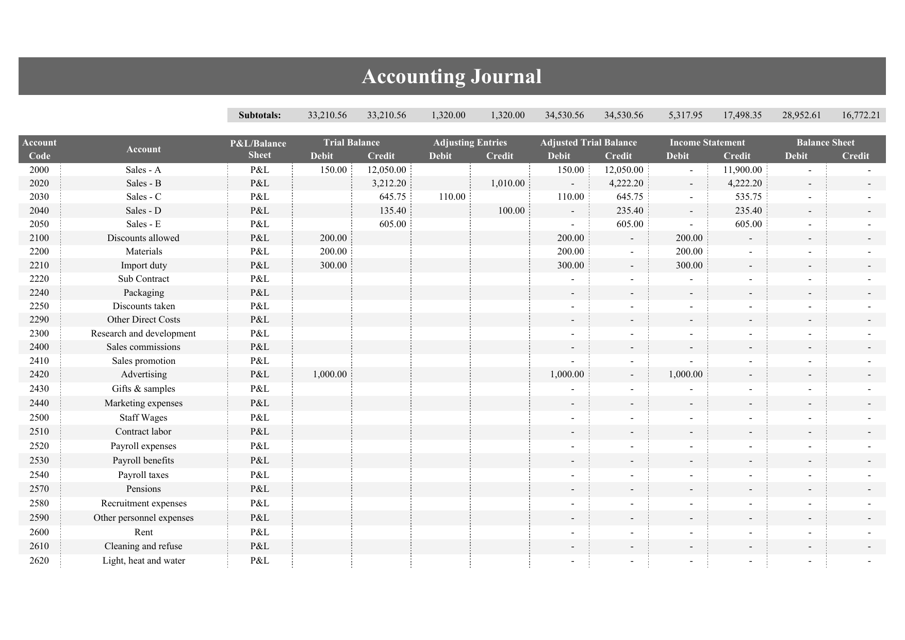

Unbalanced credits and debits impact the financial statements. Your goal with financial reporting should be to provide your stakeholders with a clear. Follow the seven steps on report writing below to take you from an idea to a completed paper.

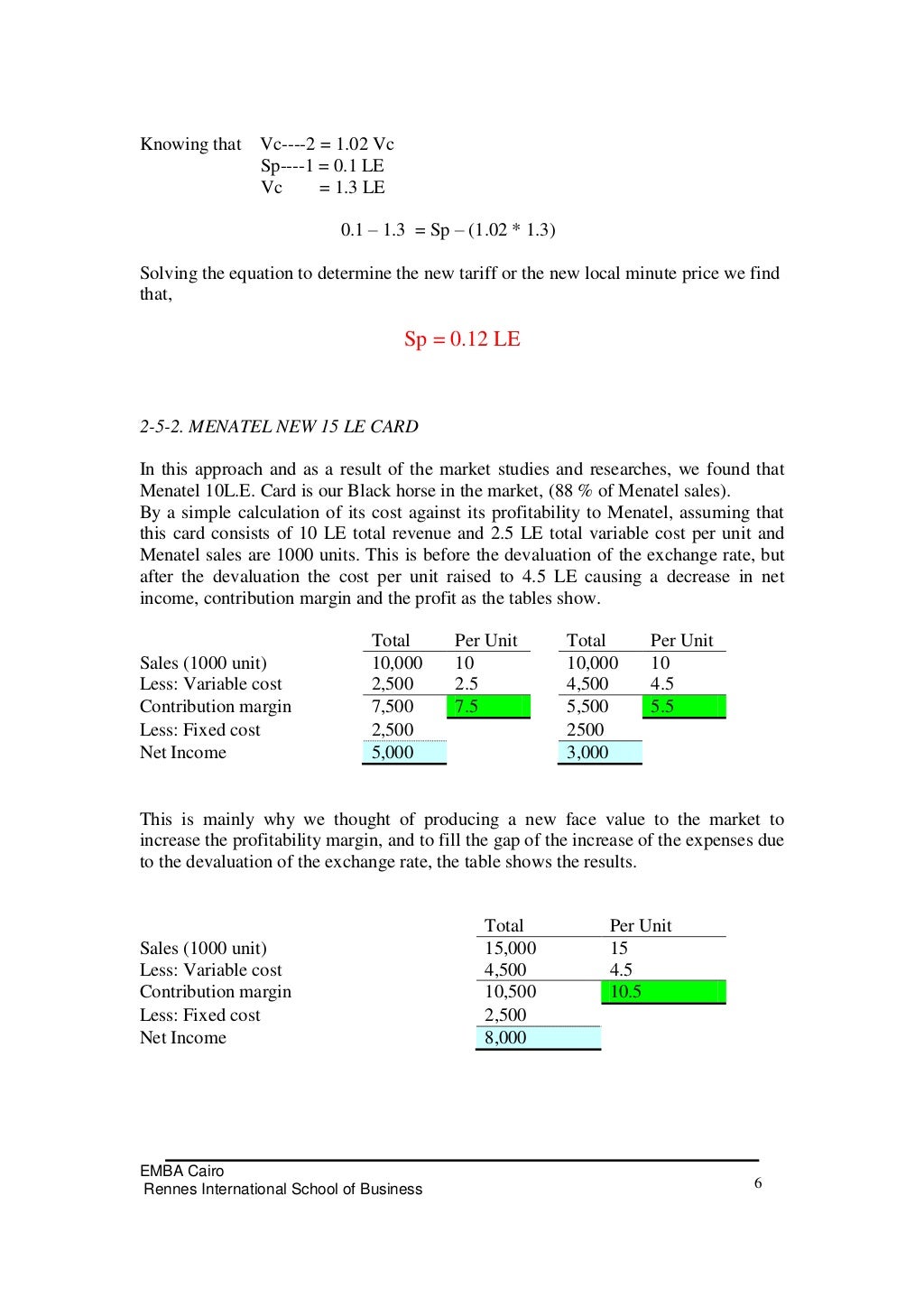

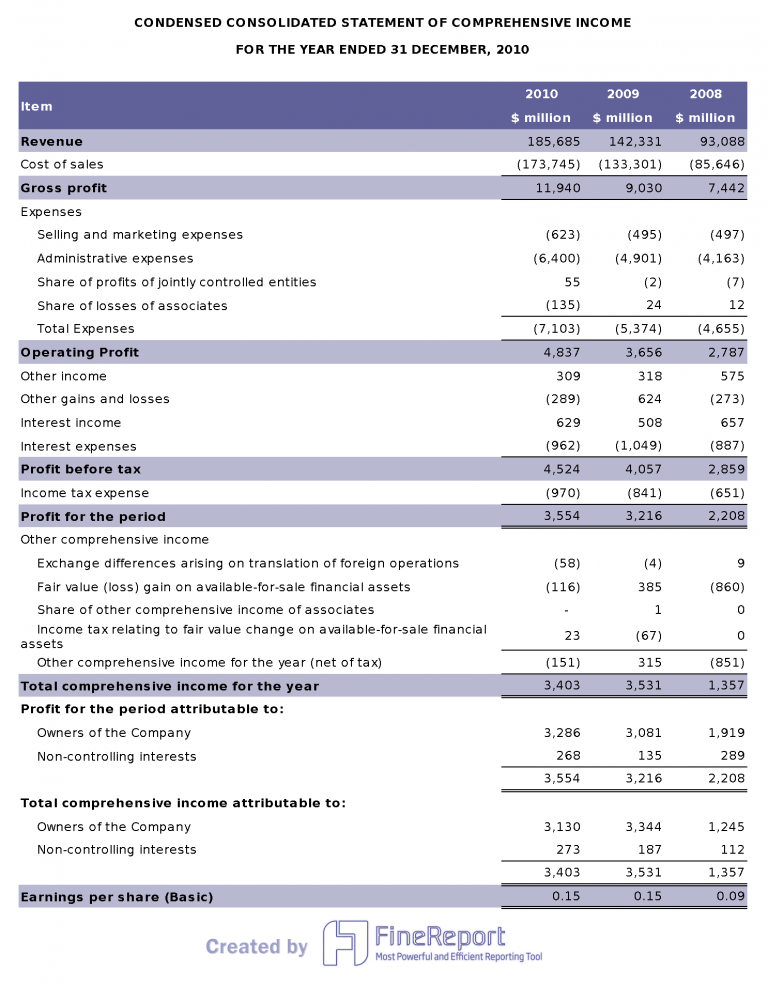

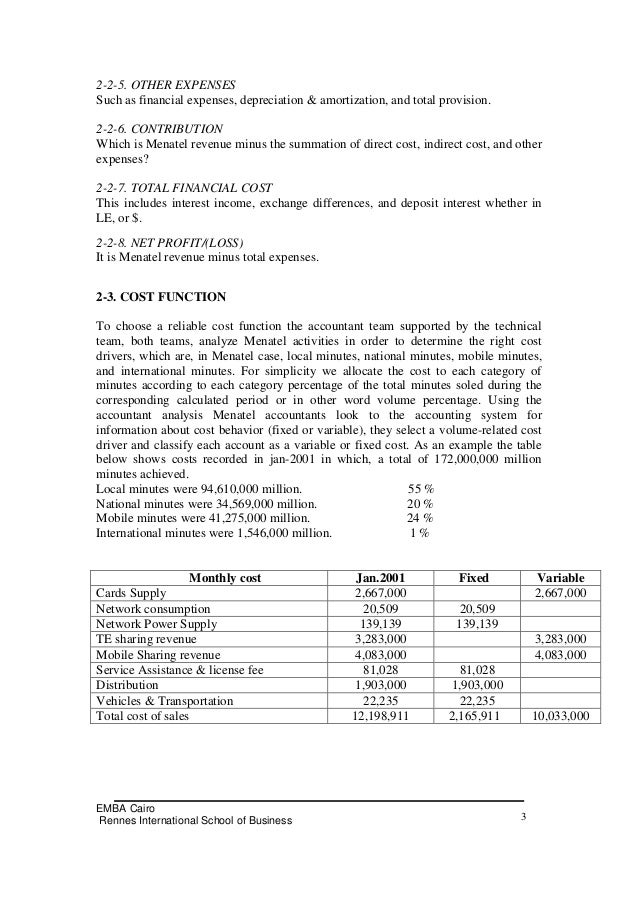

An income statement is a report that details overall expenses and revenue to determine a company's overall net profit. 4 types of accounting reports. When crafting an accounting report, understand the audience you are writing for.

These reports help you provide stakeholders with relevant information. These financial reports are prepared from the accounting data of a business. Now, we’ll explain what each of these accounting reports is in more detail, and explain when and how you might use them.

Accounting reports are necessary for every business to have. The authors offer a concise guide to writing reports that top management can act on. This shows company profits or losses over a given period.

This summarizes how much cash a company has on hand. How to write an accounting report? Ideally, readers should be able to scan through the document and get the relevant information they need.

You are telling them how much money your company made or lost. This usually begins with the income statement but also includes the balance sheet and cash flow statement. The general ledger is the foundation of your books that sorts and summarizes all transactions.

It helps you understand where your business heads, keep you on track to make enough profit, and so much more. They are a compilation of financial metrics that infers from a business's accounting records. Check out seven accounting reports you should know like the back of your hand.

One of the main tasks of a financial analyst is to perform an extensive analysis of a company’s financial statements. An accounting report can be brief comprehensive or customized for a specific purpose. To prepare an income statement, accountants use data from ledgers and.