Brilliant Strategies Of Info About How To Start A Retirement Account

Know your retirement needs when planning for retirement, think about your goals.

How to start a retirement account. Use our retirement calculator to help you understand where you. It doesn’t matter how old you are or how much you’ve already saved. An ira is an investment account designed to help you save for retirement, and you can use your account to invest in a range of assets.

An ira can be a great way to save for retirement, and there are several different. How custodial roth iras work. There are many options to choose from,.

Iras come in a variety of. Iras are retirement savings accounts that help you save for your retirement. If you want to put yourself on the path to retirement success, start saving now.

If you want to start saving for retirement, there are a number of accounts and strategies you can use. Discover the different types of iras for your retirement savings needs. Open up a traditional or roth ira, and a 401 (k) if possible.

Learn more about how to start a retirement fund here. If so, you may want to consider opening an individual retirement account (ira). Choose where to open your ira the first step is to choose what type of institution you'll open your ira through.

The sooner you start planning for retirement, the more money you can invest for the long term. After living with your parents or in a college dorm, you can afford. Then compare the ira rules and tax benefits.

Traditional iras > step 2. How much money will you need based on the lifestyle you’d like to have?. Step 1 decide which ira suits you best start simple, with your age and income.

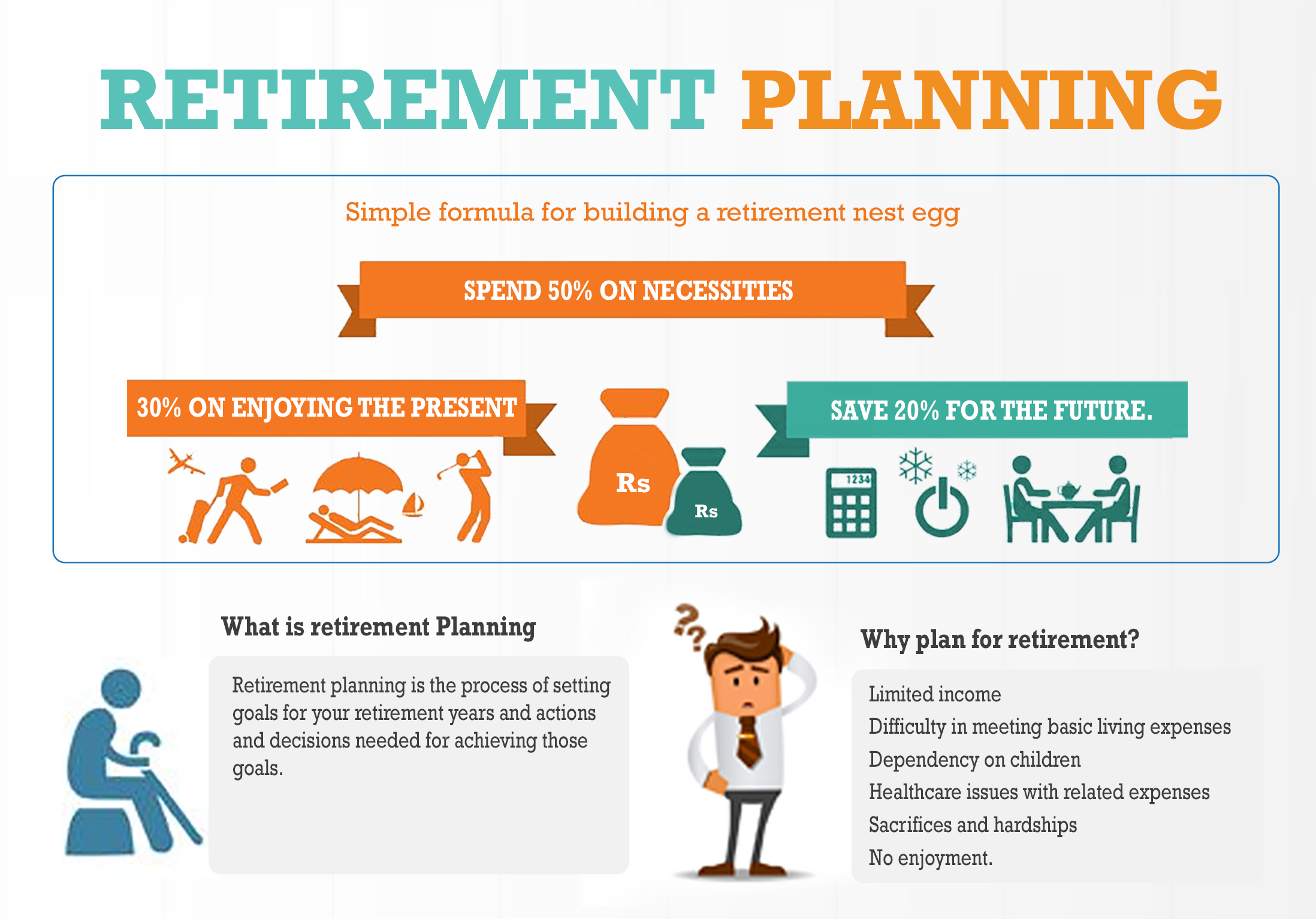

Starting in 2024, the irs limits how much you can contribute to your retirement account to $7,000 if you are under 50. The 50/30/20 rule suggests allocating 50% of income to needs (such as housing, food, and utilities), 30% to wants (entertainment, dining out, hobbies),. Your retirement checklist.

Officially, you’ll start the retirement process with your employer, letting them know when you plan to stop working. Depending on your employer and your tenure, you may need to. In your 20s, as you start your career and make real money for the first time, your spending changes.

/saving-for-retirement-with-a-late-start-38e3bb030ef242649b53f1ad16826b10.png)

![Types of Retirement Accounts [Which Is Best For You?]](https://investedwallet.com/wp-content/uploads/2020/10/retirement-accounts.jpg)