What Everybody Ought To Know About How To Claim For Tax Credits

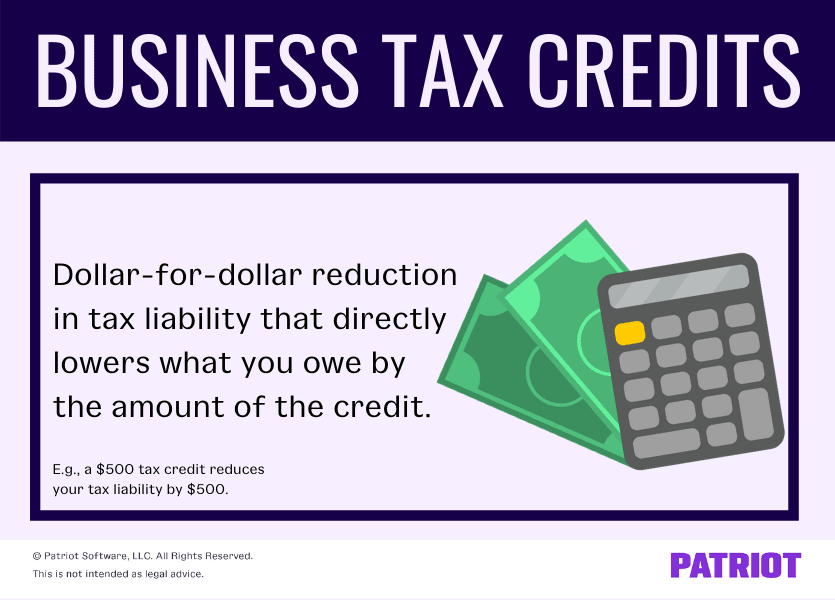

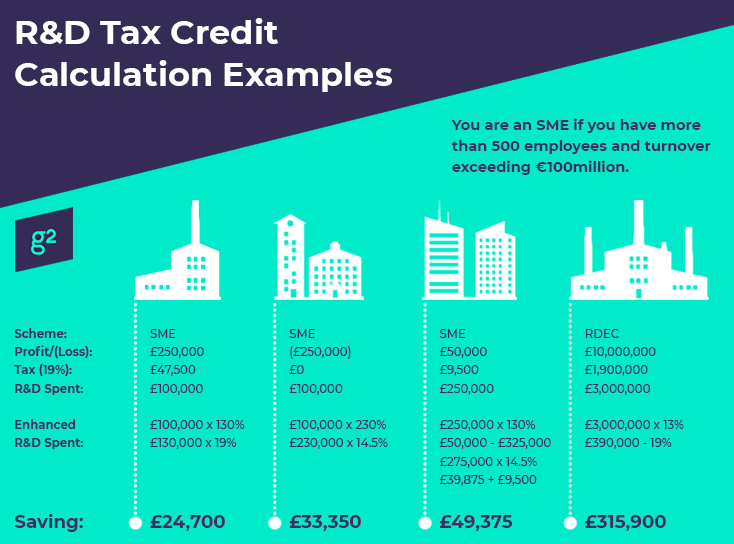

Claim credits a credit is an amount you subtract from the tax you owe.

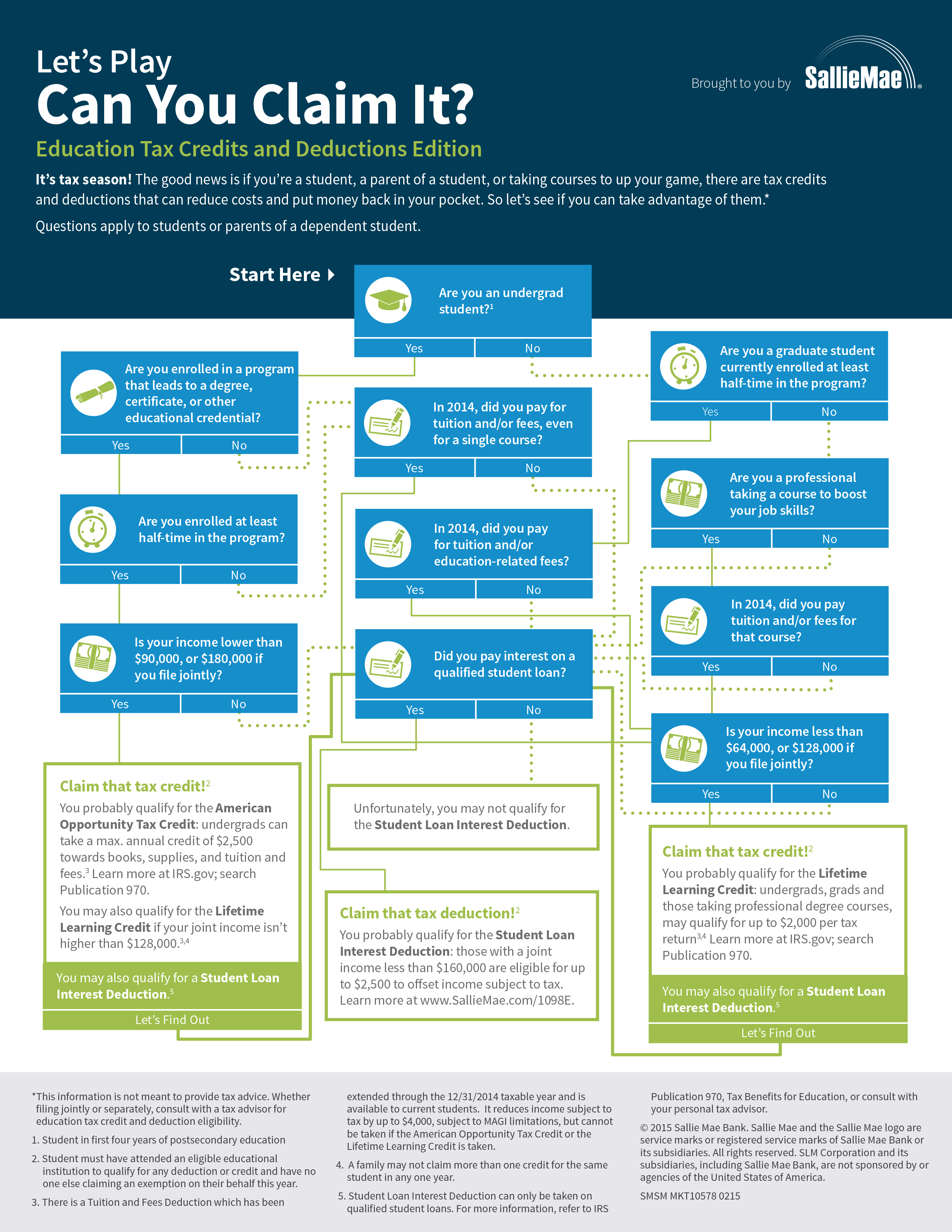

How to claim for tax credits. High income earner restriction (hier) four year rule. If you spent $12,000, you can claim 20% of your first $10,000 in costs, or. Making these upgrades together in one year would allow you a tax credit of up to $1,200 for the insulation and up to $2,000 for the heat pump.

Earned income credit: Some of the most popular tax credits fall into five categories. In that case, you would owe the irs only $500.

You can claim credits and deductions when you file your tax return to lower your tax. You can claim either the energy efficient home improvement credit or the residential energy clean property credit for the year when you make qualifying. This can lower your tax payment.

Claiming a tax refund if you are unemployed. Table of contents what is a tax credit? Foreign tax credit:

These credits are managed by the u.s. To qualify, you have to have worked in the year for which you're claiming the credit. Joint claims backdate a claim what counts as income work out your hours when to claim apply as soon as you know you’re eligible so you get all the money you’re entitled to.

Claiming tax credits is one way to pay less income tax. The earned income tax credit could be worth between $600 and $7,430 for the 2023 tax year, depending on your filing status and the number. While a lot of people focus on tax deductions as a way to shrink their tax bill, credits can be more.

Eic table 2023 (taxes filed in. The amount of your credit may change if you have children, dependents, are disabled or. For example, suppose your tax liability for the year was $1,500, but you qualified for a $1,000 tax credit.

Jump below to learn about income qualifications: Make sure you get all the credits and deductions you qualify for. Internal revenue service (irs) and can be claimed with your federal income taxes for the year.

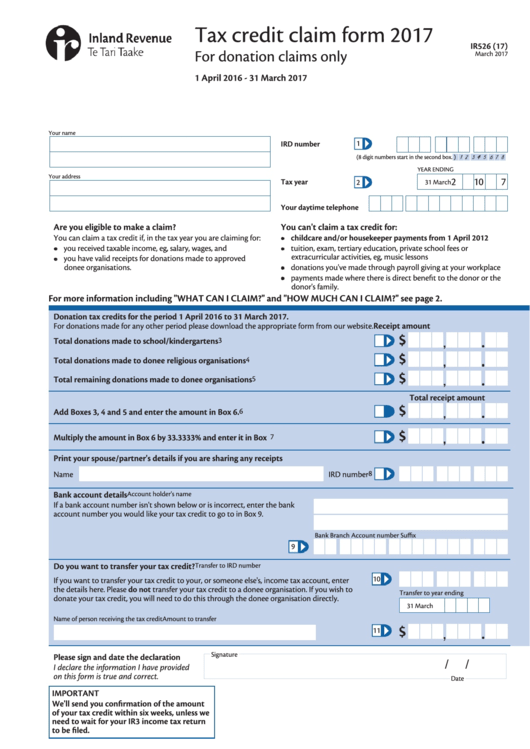

As an example, if you spent $6,000 on education in 2023, you can claim 20%, or $1,200. To claim tax credits, individuals must complete the appropriate forms and provide the necessary documentation, with refundable credits potentially resulting in a. Eligibility you can only make a claim for working tax credit if you already get child tax credit.

How do tax credits work? You’ll need to update your existing tax credit claim by reporting a change in your circumstances online or by phone. If you cannot apply for tax credits, you can apply for.