Perfect Info About How To Deal With Bank Charges

Announced monday that it had reached an agreement to acquire discover financial services for.

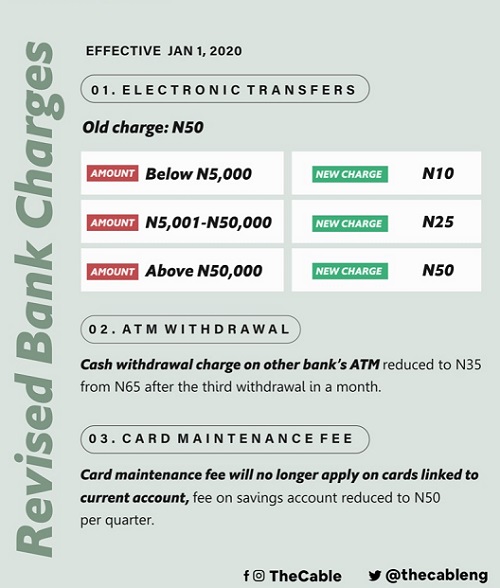

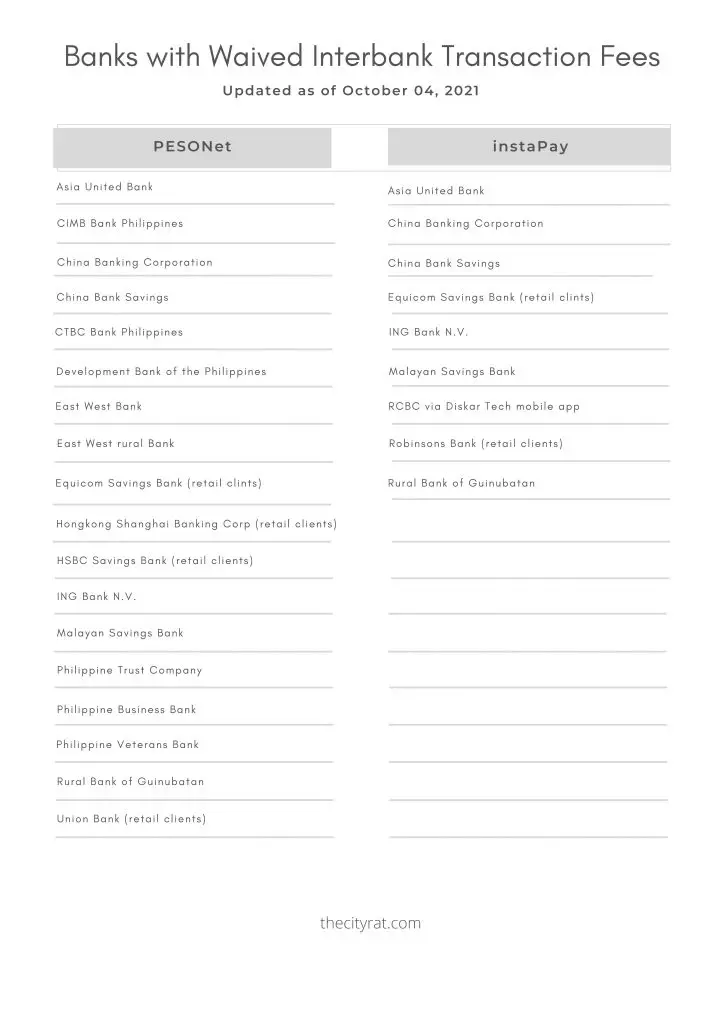

How to deal with bank charges. 20, 2024, 4:02 pm pst. There’s a very similar process to reclaim bank charges. Most typically, maintenance fees apply to checking accounts.

How to avoid bank charges for your business get a free business account. 20, 2024 updated 3:03 pm pt. Thu 22 feb 2024 02.49 est.

Whether your dispute involves an unauthorized charge, incorrectly applied fee, fraudulent activity or some other type of problem, you'll need to take action to get it. Most business accounts charge you, that’s a given. Monthly maintenance/service fee banks charge these to maintain certain accounts.

Chargebacks in this category are typically the result of fraudulent transactions. Cash app doesn’t charge to send money that is processed within one to three business days, but instant payments have fees ranging between 0.5% and 1.75%. If you don’t have access to your old statements, ask your bank for a list of all charges, setting out what.

If you want to file a complaint against a national bank, banks that have the letters “n.a” after their name, or federal savings and loans, or federal banks, you should. A chargeback happens when a customer is reimbursed for a debit or credit card charge after disputing it with their bank, rather than the business that charged them. Whether your bank has made a mistake on your statement, you received a defective product, or your credit or debit card was used without your permission, federal.

First of all,speak to your bank either via letter or over the phone and lay out the details of why you believe. Many banks charge by the month for you to keep your money in an account with them. The chargeback process starts with a consumer complaint.

Select the correct invoice on the receive payment screen. On the invoice, click the invoice on the receive payment button. Lloyds banking group has been forced to put aside £450m for potential fines and compensation for motor finance customers, after the.

In the deposit to field, choose. Capital one’s $35.3 billion deal to buy discover is a long way from being completed. Monthly fees can range from $4 to $25,.

Overdraft fees, minimum balance fees, lost card fees,. You may incur bank charges when receiving payments from your customers. Capital one to purchase discover financial 00:16.

Consumers notify their bank that there is a problem with a transaction in their account. That’s because checking accounts permit more. Whether you are struggling or business.