Neat Tips About How To Reduce Share Capital

Unable to pay future dividends.

How to reduce share capital. There are three modes for reducing the share capital. The company is to deliver a certified copy of the. Extinguish or reduce the liability;

Return of surplus capital if the company plans to return surplus capital, it will no longer require shareholders of the company. It relates only to ordinary shares. Steps to share capital reduction in hong kong.

A share capital reduction can be achieved by a variety of methods: A company has a paid up share capital of rs 6,40,000 divided into 80,000 equity shares of rs 10 each, rs 8 per share paid up. The company must first approve share capital reduction proposal by the company’s board of directors.

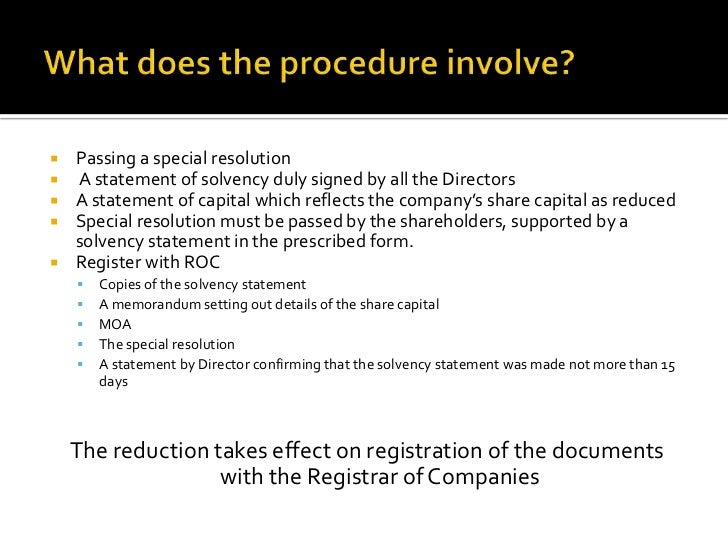

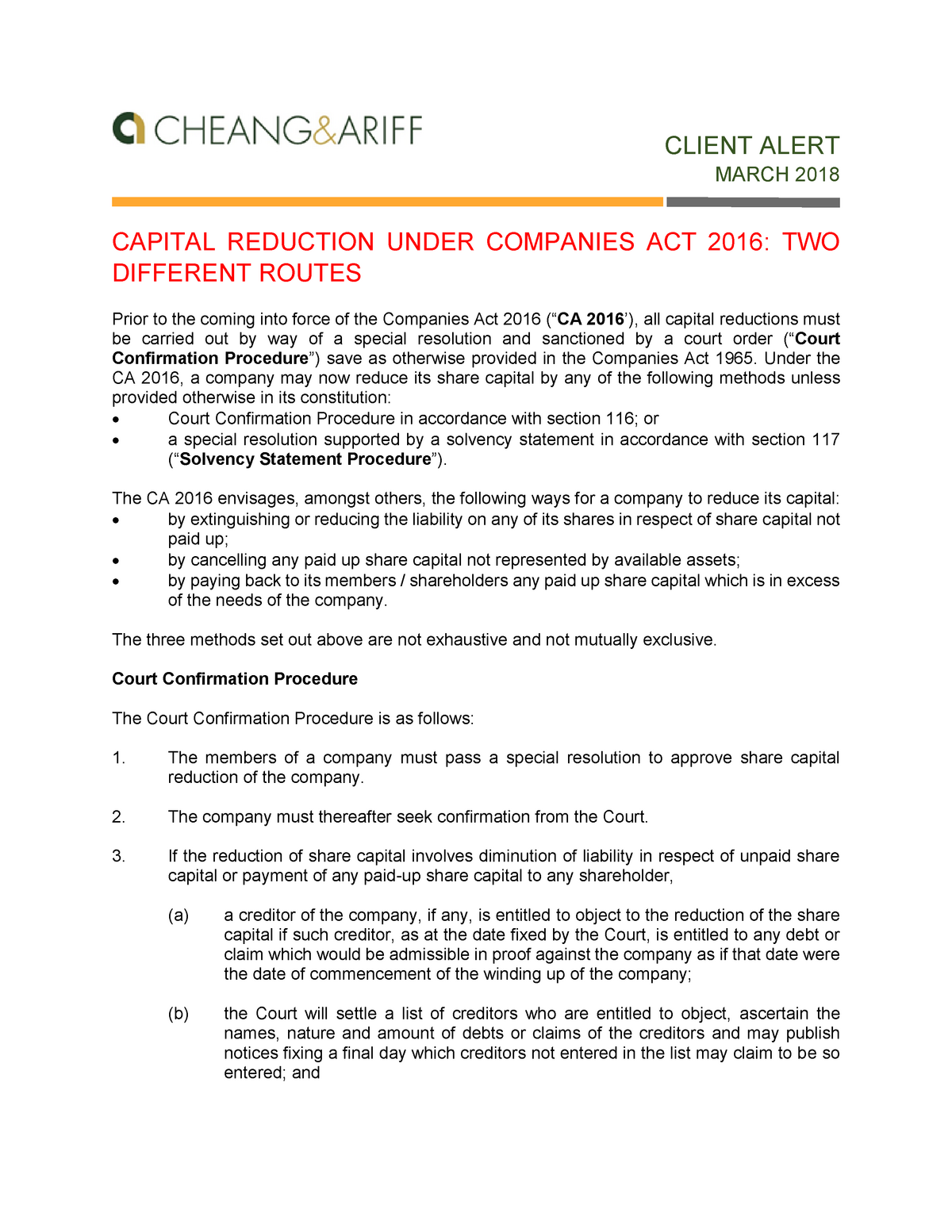

Reduction of share capital via solvency statement procedure for sdn. Section 641 of the companies act 2006 allows, for all companies, a reduction of share capital by way. The amount of share capital or.

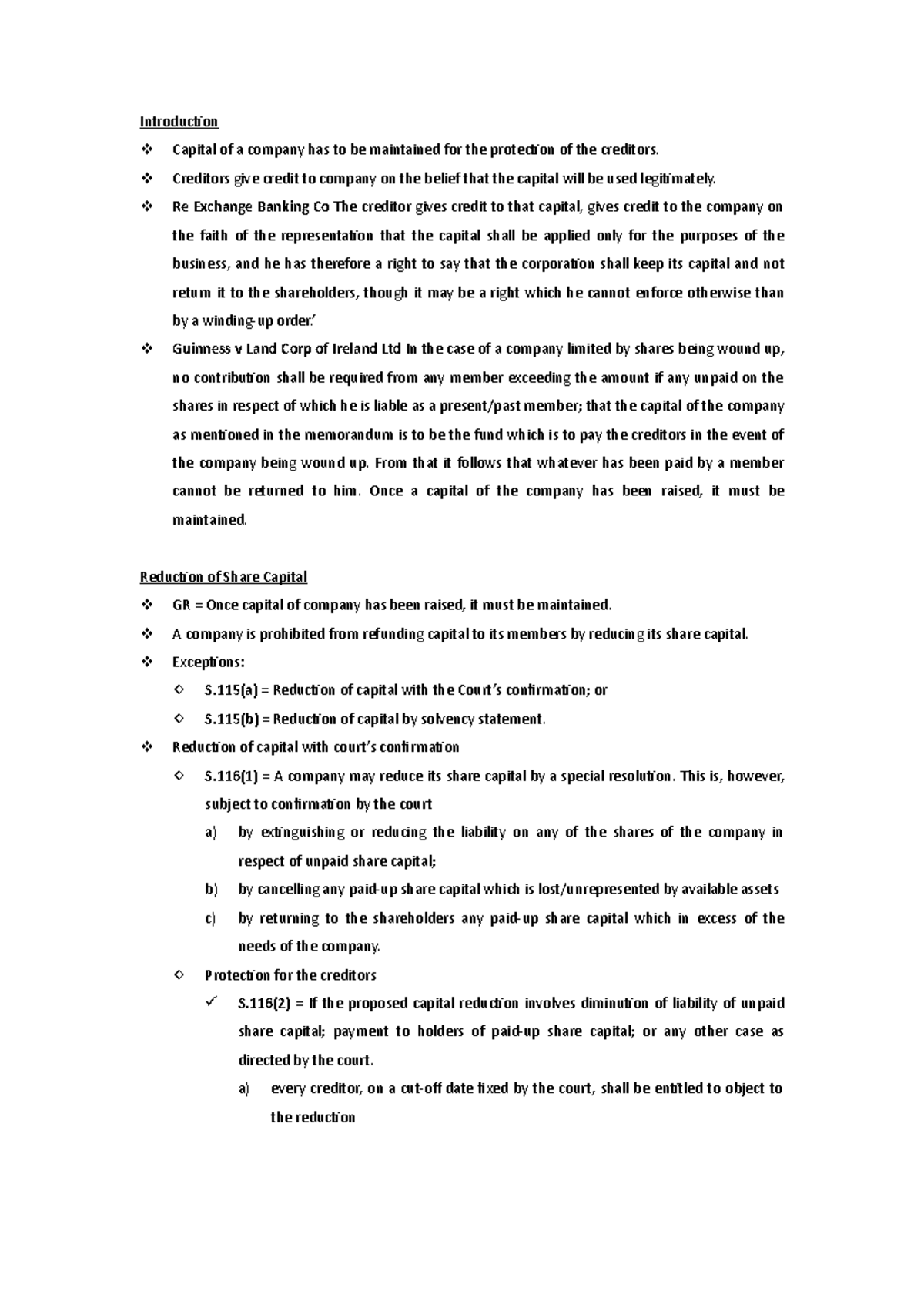

(b) filing an order of court. Modes of reduction of share capital. A company may reduce its share capital by doing either of the following:

There are two ways in which a limited company can reduce share capital, by way of a court order or by issuing a solvency. This reduction of share capital confirmation order is to be published by the company as directed by the tribunal. Under section 115 (b), ca 2016, unless otherwise provided in the constitution, a.

By 24 february 2024, after the formalities were recorded in the companies register, the bank's share capital stood reduced by eur 17,774,184 to a new total of. An equal reduction must meet these three conditions: Extinguish or reduce the liability 2.

Capital reduction is the process of decreasing a company's shareholder equity through share cancellations and share repurchases, also known as share buybacks. Methods for reducing share capital a private company can either reduce its share capital: Share capital consists of all funds raised by a company in exchange for shares of either common or preferred shares of stock.

Cancelling share capital no longer supported by the company’s assets; Or through a court order. An equal reduction, or a selective reduction.

The profit and loss account shows a credit balance. Rules for reducing share capital. The number of shares remains unchanged.

![Alteration of Share Capital [PPT Powerpoint]](https://reader017.fdocuments.in/reader017/slide/2019120521/544c0fd2af79599c438b57bc/document-5.png?t=1597330200)