Awesome Info About How To Buy Off The Plan

You can get discounts of up to 30% by buying off.

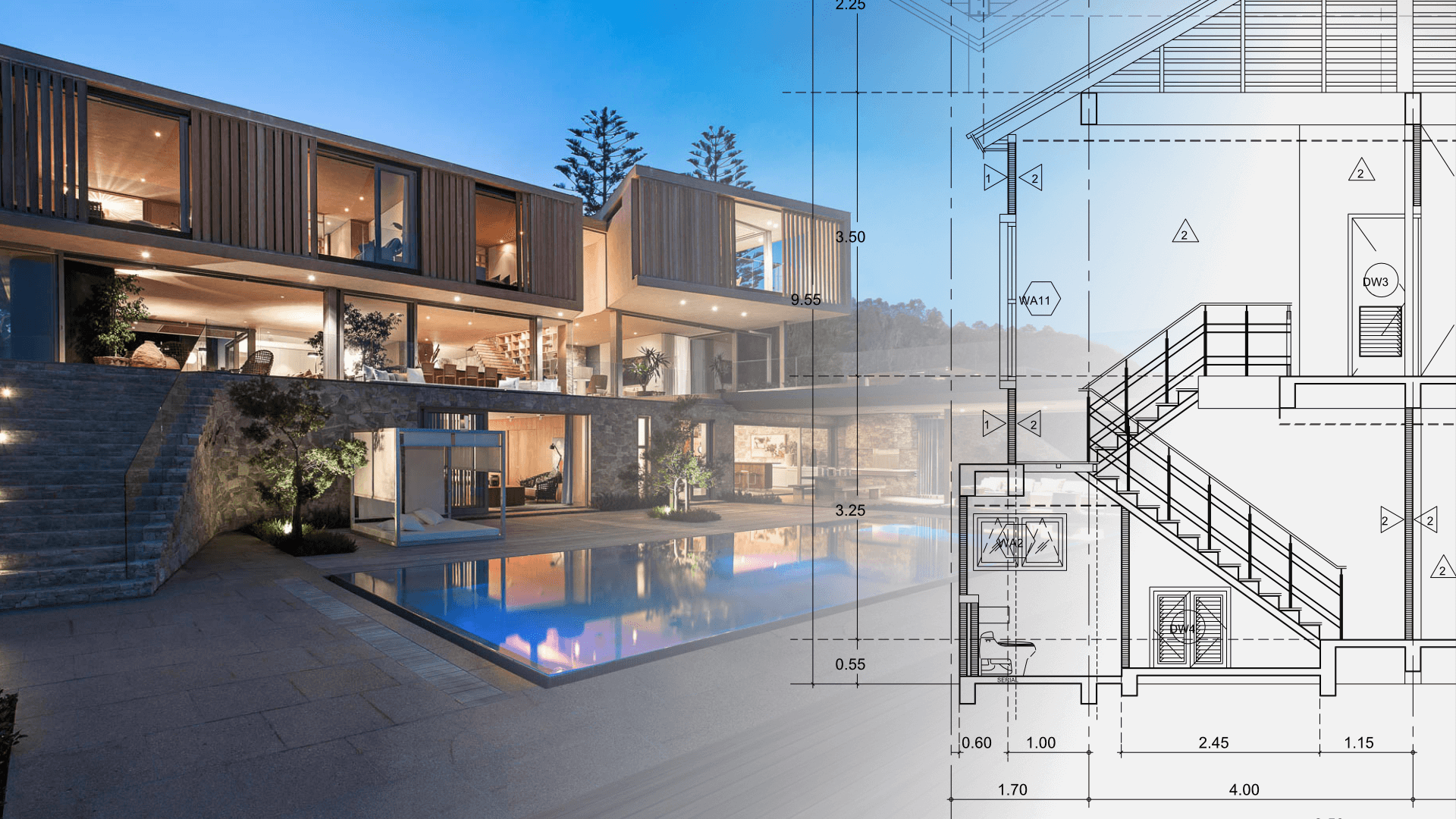

How to buy off the plan. Here are five tips to help you navigate a. There are now 7.5 million borrowers enrolled in the save plan, of whom 4.3 million have a $0 payment. Buying off the plan has been a favoured strategy of many australian investors and homebuyers, particularly in a rising housing market.

What is ‘buying off the plan’? The size of the discount depends on the estimated time frame to completion and the amount of perceived risk in the development. Aht) (ashford trust or the company) today provided an update on its previously announced plan to pay off its strategic.

You make your decision to buy based on the. Preapproval is crucial when buying off the plan property, as it helps establish a budget, strengthens. Buying off the plan means that you agree to buy a home that is yet to be built.

But, like any investment, there are. Understanding buying a home off the plan. How much deposit do i need to buy off the plan?

In some cases, construction may not have started while in others it may. What is buying off the plan? Ashford hospitality trust, inc.

Investors should start planning their purchases for when the market cools off. The plan is usually offered by developers or builders. Buying off the plan is viewed by many, including home owners and investors, as a smart way to get a new property.

Buying off the plan properties can be a rewarding investment strategy, but it requires careful planning and consideration. Buying off the plan means buying a property that hasn’t been built yet or is still under construction. That debt cancellation could come as soon as this year.

To help you decide if buying off the plan is a good idea for you, here we’ll look at the pros and cons. Speak to a mortgage broker the first step in any home buying process is to speak to a mortgage broker and find out if you can borrow what you need for your. Buying off the plan offers some great benefits, but it is important to remember it doesn’t come without risk.

Buying off plan pros and cons. In a rising market, buying off the plan can also be a good strategy because you only have to put a deposit down and settle when it is completed. Buying off the plan involves signing an off the plan contract of sale, which is drafted and tailored quite differently to a normal contract,.

In some states, like victoria, there may be an off the plan duty concession. Buying off the plan means entering into a contract to purchase a property before the property title is created and construction is complete or has even started. Today, president biden announced the approval of $1.2 billion in student debt cancellation for almost 153,000 borrowers currently enrolled in the saving on a valuable.